EUR/GBP: Down from £0.87 to £0.86

EUR/USD: Up from $1.20 to $1.22

An improving economic outlook in the Eurozone has been a key source of support for the euro over the past month. This comes in response to the continued acceleration of the EU 's vaccine rollout as well as the reopening of more countries within the bloc.

This upside in the euro has also been supported by recent EUR data releases, which have been broadly positive and point to a strong rebound in economic activity in the second quarter. However, confirmation that the bloc suffered a double-dip recession over the winter ensured it wasn 't all plain sailing for the single currency. Turning to June, we are likely to see the euro maintain its recent uptrend as the Eurozone 's economic prospects continue to improve.

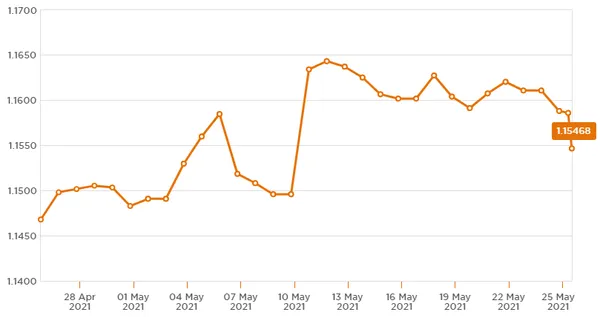

GBP/EUR: Up from €1.14 to €1.15

GBP/USD: Up from $1.38 to $1.41

The past month has seen the pound trend broadly higher, with the most notable upswing in Sterling coming in response to reduced political uncertainty in the UK. This came after the Scottish National Party failed to secure an outright majority in May 's election, reducing fears of an immediate independence referendum. Also providing some lift to Sterling has been the reopening of more of the UK economy and positive domestic data releases, although these gains have been tempered somewhat, in the second half of May by UK coronavirus developments. With the spread of the Indian variant of the coronavirus in the UK threatening to disrupt the government 's roadmap for easing restrictions, domestic coronavirus headlines are likely to act as a key catalyst of movement in the pound in the weeks to come.

USD/GBP: Down from £0.72 to £0.70

USD/EUR: Down from €0.82 to €0.81

After fluctuating in late April in response to a dovish Federal Reserve policy statement and upbeat GDP figures, the US dollar experienced an aggressive selloff at the start of May following a startling miss in the latest US payroll reading. A sharper-than-expected acceleration of domestic inflation in April helped the 'Greenback ' to claw back some of its losses in the week that followed. However, this upside in USD proved short-lived, amidst expectations the Fed will continue to view the surge in inflation as 'transitory ', as well as in the face of an increasingly upbeat global outlook, which has sapped safe-haven demand. Looking ahead, USD investors will likely be keeping a close eye on May 's payroll figures, as another underwhelming reading will likely keep the pressure on the US dollar and validate the Fed 's current dovish bias.

At Currencies Direct, we're here to talk currency whenever you need us, so get in touch if you want to know more about the latest news or how it could impact your currency transfers. Since 1996, we've helped more than 325,000 customers with their currency transfers, just pop into your local Currencies Direct branch or give us a call to find out more.