Staying on top of the latest currency news can help you time your transfers more effectively, so find out what you should be looking out for over the next couple of weeks…

Hopes that the global economy is starting to recover as countries ease lockdown measures boosted market optimism last week. However, US-China trade tensions have capped some risk appetite and lingering Brexit concerns are weighing on the pound.

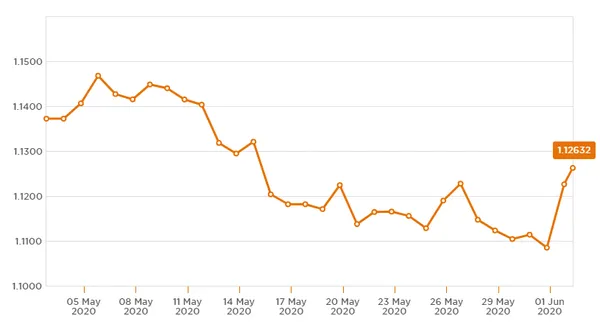

The GBP/EUR exchange rate dipped from highs of €1.12 to lows of €1.10 while the EUR/GBP rose from £0.88 to £0.90. Meanwhile, GBP/USD climbed from lows of $1.21 to highs of $1.24, while the EUR/USD edged higher to around $1.11.

The pound edged higher at the beginning of last week after Andrew Haldane, the Bank of England's chief economist, said that the UK's economic data had been a 'shade better' than forecasts. Last week also saw Prime Minister Boris Johnson's announcement that all non-essential shops could reopen from the 15th June, buoying investors' hopes for a quick economic recovery. However, concerns about upcoming Brexit talks left Sterling struggling before the weekend.

Meanwhile, the euro fluctuated amid a raft of improving - but still predominantly negative - economic data. For example, Wednesday saw the release of the flash annual German inflation data for May, which dipped from 0.8% to 0.5%. The single currency benefited greatly from a sense of resolution as the European Union announced its €750bn recovery fund, pushing the euro higher against its rivals.

The US dollar slumped last week as more economies began easing lockdown measures, improving market sentiment and increasing risk appetite. USD losses were limited by returning US-China trade tensions however.

What do you need to look out for?

The euro could edge higher this week if Eurozone economic data confirms hopes that the bloc is making a steady recovery as its largest economies - including Germany and France - continue to ease lockdown measures. However, Germany's Unemployment Rate for May is forecast to rise from 5.8% to 6.2%. A sharp increase in joblessness in the Eurozone's largest economy could be euro-negative. Thursday will see the ECB announce its latest interest rate decision. While policy isn't expected to change, any dovish comments may have a negative impact on EUR.

In UK economic news, we have the UK Market Services PMI for May. If this confirms consensus and edges higher from 27.8 to 28 Sterling could enjoy a (very modest) amount of support. The US dollar will most likely be driven by US-China trade developments and domestic political unrest this week. Any signs of escalating tensions between the world's two largest economies could dampen risk sentiment, increasing demand for the safe-haven 'Greenback'.

At Currencies Direct, we're here to talk currency whenever you need us, so get in touch if you want to know more about the latest news or how it could impact your currency transfers. Since 1996, we've helped more than 325,000 customers with their currency transfers, just pop into your local Currencies Direct branch or give us a call to find out more.